This article is for users with administrator permissions, belonging to organisations that file income tax returns.

Overview

With TaxLab’s Inland Revenue (IR) integration, you can e-file returns directly with IR and receive IR correspondence in your workspace. If you’re a tax agent, the integration can also retrieve tax payment transactions and automatically import your full client list, creating entities for each client in the software. You’ll need to enable this separately for each client list you want to connect.

This article walks you through enabling your myIR credentials and setting up the IR integration.

Inland Revenue - myIR credential

The myIR credential is what enables the integration between your TaxLab organisation and IR’s services. Once your credentials have been enabled, you can add this to your IR integration which will allow IR data to be sent and received by the entities on those lists, in TaxLab.

You can add your myIR credential to the client list/s and businesses you have the right access to. So one myIR credential may enable many IR integrations, depending on which user performs the authentication.

For Tax Agent integrations:

| myIR credential | myIR credential | myIR credential | |||||||||

| IR - Tax Agent integration | IR - Tax Agent integration | IR - Tax Agent integration | IR - Tax Agent integration | ||||||||

| Client list | Client list | Client list | Client list | ||||||||

| Entity | Entity | Entity | Entity | Entity | Entity | Entity | Entity | Entity | Entity | Entity | Entity |

For Customer integrations:

| myIR credential | myIR credential | myIR credential | myIR credential | |

| IR - Customer integration | IR - Customer integration | IR - Customer integration | IR - Customer integration | |

| Entity | Entity | Entity | Entity | Entity |

Create a myIR credential

To successfully enable your myIR credential you must have the following access in myIR:

- Tax agency integrations: You must have 'Owner' or 'Administrator' (unrestricted) access to the client list in myIR.

- Customer integrations: You must have 'Full account access' to the tax account in myIR.

You can read more about IR access for Tax Agents here.

We recommend checking your access rights in myIR before completing the steps below.

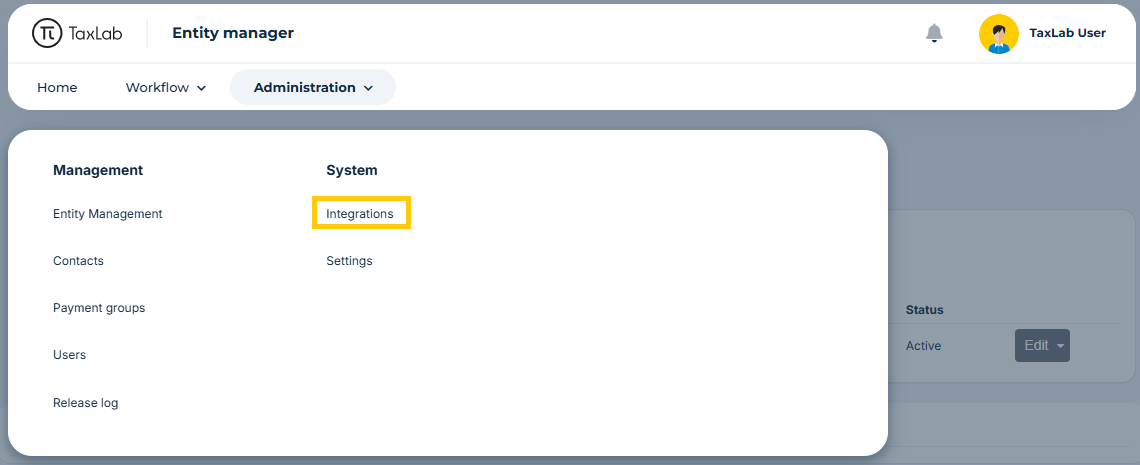

- From your TaxLab home page, in the navigation bar select Administration > Under System > select Integrations.

- In Integrations, select New > myIR credential.

- Assign a display name to your myIR credential. This should be easily identifiable to you and other users.

- Select Save.

- Next, you'll be redirected to the Inland Revenue website, where you'll be prompted to provide your myIR Username and Password.

- For tax agents, enter your myIR login details for the tax agency client lists you wish to connect.

- For business, enter your myIR login details that you use to access the business(es) in myIR.

- Select Log in.

- IR will prompt you to review their conditions of use and authorise TaxLab access to IR.

- Once you’ve authorised the access, you will be redirected back to TaxLab.

Add an Inland Revenue integration

Once your organisation has a myIR credential added, you next need to set up the IR integration. This is what your entities are added to, to send and receive information from IR. For Tax agents you will need one IR integration per client list, and for businesses you will need one IR integration per entity or Consolidated tax group.

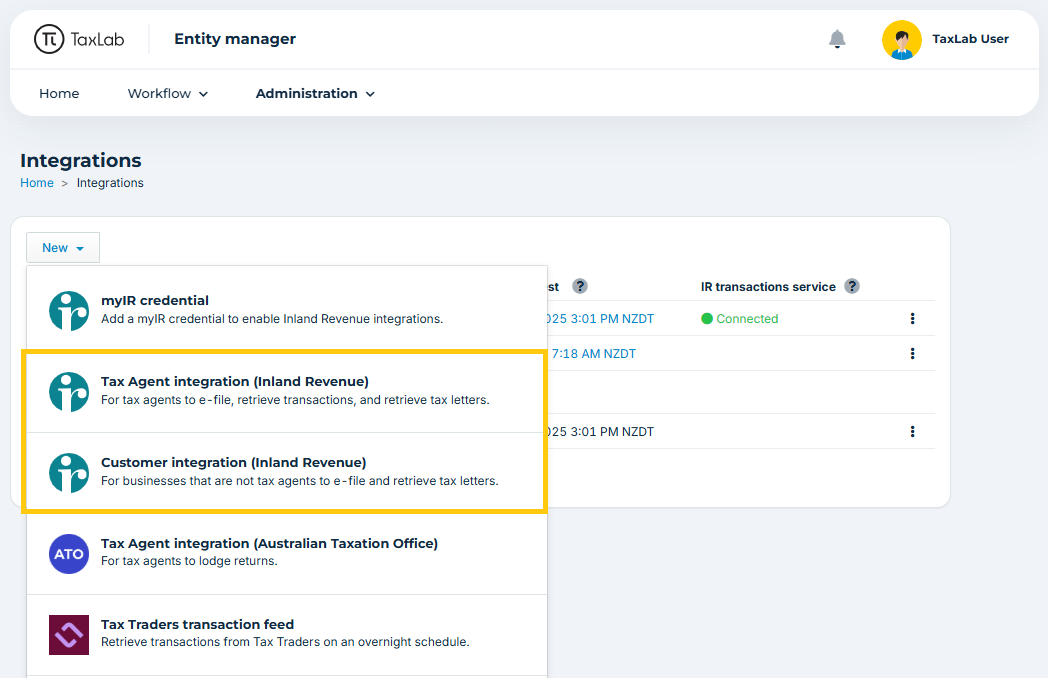

- From the TaxLab Integrations page, select New:

- If you're a Tax agent select Tax Agent integration (Inland Revenue)

- If you're a Business select Customer integration (Inland Revenue)

- Assign a display name to the integration. This should be easily identifiable, with reference to the client list name or business name.

- Enter your Tax agency or Customer IR number:

- For Tax agency integrations, enter your Tax agency IRD number and the Client list ID number.

- For Customer integrations, enter the IRD number for the business.

- For Tax agency integrations, enter your Tax agency IRD number and the Client list ID number.

- Under Authentication, myIR credential, select the dropdown arrow on the right and choose the myIR credential needed for the integration.

- Select Save.

Changing a myIR credential

If you need to update a myIR credential, such as when the person who originally set it up is no longer with the organisation, follow these steps:

- Create a new myIR credential.

- Update the integration: Once the new myIR credential has been created, select the settings cog to the right of the integration.

- Select the x to remove the previous myIR credential.

- Use the drop down arrow on the right to select the new myIR credential.

- Select Save.

A user with Administrator access to an organisation can edit an IR integration regardless of who created it.

Troubleshooting

Do I need to set up more than one Inland Revenue integration?

For Tax agent integrations: Each client list will require its own IR integration. However if you have access to more than one client list on your Tax agency you will not need to set up another myIR credential.

For Customer integrations: If you access your business in myIR via separate logins then you’ll need to set up a myIR credential for each login. Every entity will need its own IR integration.

What's next?

Now add entities to an organisation.

Related articles

Learn how to reauthenticate an IR application gateway.

Learn more about correspondence tasks.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article