Overview

Workpapers are used to make adjustments to income tax calculations, ensuring accurate tax reporting.

How workpapers function

Workpapers can either be added to a trial balance account, or directly to an entity. The adjustments in the workpapers apply throughout the tax calculation. Users can review these in the income tax position, where the applied adjustments will be displayed.

Sign conventions

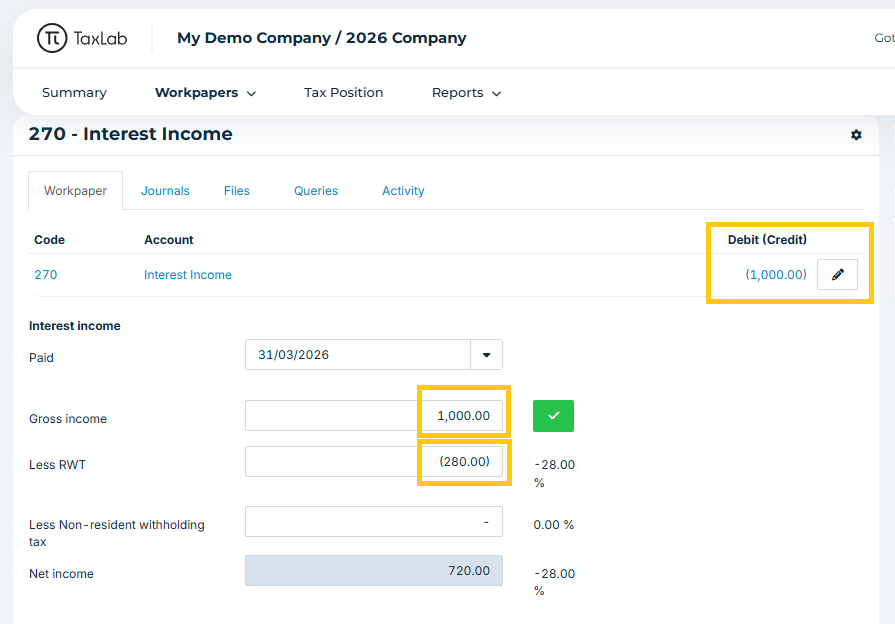

In the trial balance, income, liability and equity accounts are shown as negative amounts (credits), and expenses and assets positives (debits), reflecting standard accounting presentation. However, when using a workpaper, amounts are displayed based on their impact on taxable income. Adjustments entered into a workpaper that increase taxable income (such as non-deductible expenses) should be entered as a positive amount. Adjustments that reduce taxable income (such as non-assessable income) should be entered as a negative amount. This extends to tax payable. Tax credits that reduce tax to pay, are entered as negative numbers to workpapers.

Locating workpapers

You can access and view workpapers in two ways:

From the trial balance

In the Trial balance view, click on the name of a workpaper linked to an account. This will open the workpaper directly, allowing you to review or update its details.

From the workpapers list

To see all workpapers associated with a tax return, from the navigation bar select Workpapers > Workpapers.

This view displays all workpapers for the selected tax year, categorized into:

- Not in accounts: Workpapers added at the entity level, not linked to a specific account.

- Trial balance: Workpapers directly associated with accounts in the trial balance.

Use the Export button to download the full list as an .xls file for further analysis or record-keeping.

From the Workpapers list, you can also:

- See the tax impact of each workpaper on the return.

- Review and respond to queries or comments.

- Check calculations and ensure accuracy.

- Track signoffs for approvals and compliance.

Types of workpapers

Workpaper availability depends on:

- Entity type: Different entity types have specific workpapers.

- Account type: Different workpapers are available depending on whether you are adding it to a balance sheet or income statement account.

Using formulas in workpapers

Instead of manual adjustments in workpapers, formulas or percentages can be used. For example, entering "=50%" applies a percentage-based adjustment to the balance amount.

Key benefits of using formulas:

- Automatic updates: Adjustments recalculate if the trial balance changes.

- Visual indicators: When a formula is used, the Formula icon (x squared) on the Trial Balance page turns blue.

Rolling workpapers forward to the next tax year

Workpapers automatically roll forward to the next tax year and retain all applied formulas to maintain consistent calculations across reporting periods.

What's next?

Related articles

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article