Overview

The Tax Account Movements report tracks the movements through the tax accounts from the opening balance, prior period adjustments and current period movements to a closing balance. The closing balance for deferred tax and current tax is reconciled against the Deferred Tax Proof and Current Tax Proof.

Tax account movements settings

From the entity's tax year summary, in the navigation bar select Reports > Tax Account Movements. In the Tax Account Movements report, select the settings cog.

By default, the report displays:

- Aged Current Tax: shows the current tax balance on an aged basis.

- A reconciliation with the Current Tax Proof and Deferred Tax Proof, to see whether the proofs equal the movements for the year and identify any discrepancies.

- The Ledger Reconciliation, which reconciles the report with the accounting ledger and provides the required journal entries.

Selecting Merge Tax Expense will merge Current Tax Expense and Deferred Tax Expense into one column.

Add opening balances

Enter the opening balances for Deferred Tax and Current Tax for the year. These are usually the closing balances from the prior year’s final financial statements. Do not enter Tax Expense, as this always start at nil at the beginning of each year.

- From the Tax Account Movements report, select New > Opening Balance.

- Edit the Journal Narration to describe the entry, e.g. “202X Residual Income Tax”

- Enter the amounts of the journal into the Current Tax and Deferred Tax boxes. This does not need to balance. Any amounts entered in the Credit column should be positive amounts.

- Optional: Add Notes.

- Select Save.

Create a prior period adjustment

There are three different ways to enter prior period adjustments,

Create a manual prior period adjustment

Use this method in the first year of preparing tax balances in the software.

- From the Tax Account Movements report, select New > Journal Entry – Prior Period Adjustment.

- Edit the Journal Narration to describe the entry, e.g. “Prior period adjustment"

- Enter the amounts of the prior period adjustment journal. This must balance. Any amounts entered in the Credit column should be positive amounts.

- Optional: Add Notes.

- Select Save.

Other settings such as date and tax year can be changed if required but usually do not need to be changed from the default.

Create an automated prior period adjustment

Use this method if a version was created when preparing the prior year’s tax balances, and a version of the prior year’s tax return exists. The system compares the tax calculation from the prior year’s tax balances version with the tax calculation from the prior year’s tax return version, and automatically creates a journal for any differences.

- From the Tax Account Movements report, select New > Journal Entry – Automated Prior Period Adjustment.

- Edit the Journal Narration to describe the entry, e.g. “Prior period adjustment".

- In the first Version drop-down list, select the version and year that you want the prior period adjustment to be calculated from. Usually this is the year end tax balances version.

- In the second Version drop-down list, select the version and year that you want to compare the above version with. Usually this is the tax return version.

- View the side-by-side versions, and the journal entry (prior period adjustment) that will be created.

- Select Create Journal.

Other settings such as date and tax year can be changed if required but usually do not need to be changed from the default.

Delete an automated prior period adjustment

- From the Tax Account Movements report, select the name of the prior period adjustment to open it.

- Select Delete.

Journal entries for prior period adjustments for current or deferred tax only need to be manually added in the first tax year. Once in the second tax year, and there are at least two versions of the first year calculation, the software will create an automated prior period adjustment.

Create a prior period adjustment from deferred tax

Use this method to create prior period adjustment journals from the Deferred Tax > Prior Period tab. This method is useful for recording movements between the year end and the tax return that are not captured in the tax calculation, such as changes in the closing net book value of assets or movements through equity.

Add a current period adjustment

The entries in the Current Period Adjustments section automatically populate from the tax calculation, tax payments, workpapers, losses and movements in deferred tax. However occasionally it may be necessary to manually enter an adjustment.

- On the Tax Account Movements tab, select New > Journal Entry – Current Period Adjustments.

- Edit the Journal Narration to describe the entry, e.g. “Current period adjustment".

- Enter the amounts of the journal. This must balance. Any amounts entered in the Credit column should be positive amounts.

- Optional: Add Notes.

- Select Save.

Other settings such as date and tax year can be changed if required but usually do not need to be changed from the default.

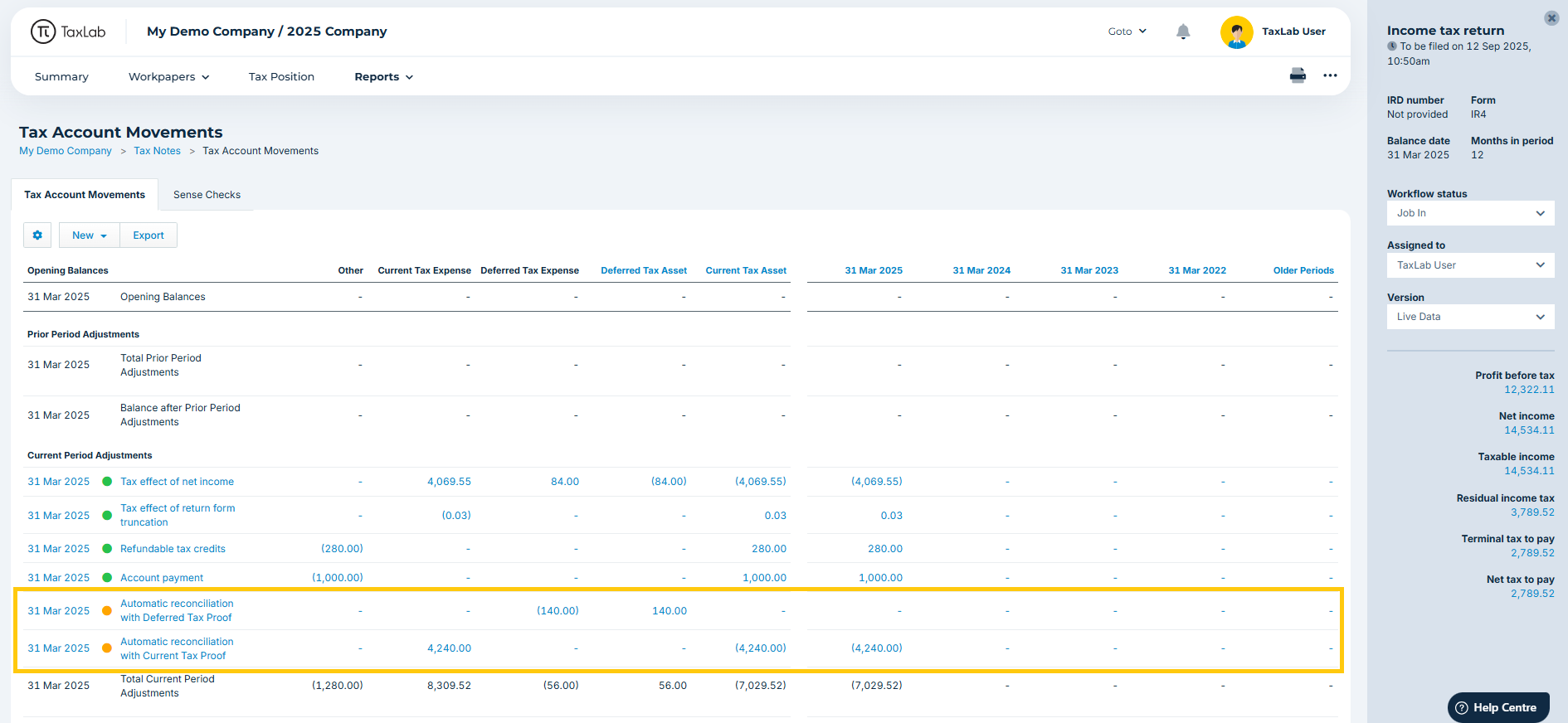

Automatic reconciliations

When Automatically reconcile with Current Tax Proof or Deferred Tax Proof are ticked using the settings cog, two additional lines will appear in the Current Period Adjustments section:

- Automatic reconciliation with Deferred Tax Proof: this sums the movements in the Deferred Tax Asset column from Opening balance, Prior Period adjustments and Current Period adjustments and compares the sum of the movements to the Deferred Tax Proof balance. Any difference is populated into this line. Ideally, this should be as close to nil as possible as it means that any movements through deferred tax are accounted for in Tax Account Movements. Further investigation should be undertaken if there is a material amount in this line.

- Automatic reconciliation with Current Tax Proof: this sums the movements in Current Tax Asset column and compares the sum to the Current Tax Proof. Any difference is populated on this line and ideally should be as close to nil as possible.

View and resolve sense checks

From the Tax Account Movements report, select the Sense Checks tab to see if the software identified any discrepancies within the tax calculation. Once an issue has been resolved, it will move to the Passed tab. Sense checks cover the following items:

- Accounts

- Statement of taxable income (SOTI)

- Tax account movements

Troubleshooting

If there are any issues with amounts:

- Check that opening balances are entered correctly

- Check that prior period adjustments are all accounted for.

- Compare the Balance after Prior Period Adjustments line in the Current Tax Asset and Deferred Tax Asset columns with the balances calculated from the prior year’s tax return.

- Review all movements through Current Period - were any manual entries added that are actually accounted for in the movements already?

- Review the deferred tax proof to ensure you agree with the closing balance.

- Review the current tax proof to ensure you agree with the closing balance.

What's next?

Reconcile tax balances with the accounting ledger

Related articles

Assign accounts in a trial balance

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article