Overview

The current tax proof report displays all transactions that make up the current tax asset or liability balance. This article explains how to access the report, view its components, and add or edit adjustments.

Access the current tax proof

From within an entity's income tax year, in the navigation bar select Reports > Current Tax Proof.

The proof displays all tax transactions, by tax year, including Inland Revenue tax payments, transfers or assessments, tax pooling transactions, the current tax charge, and any manually added journal adjustments. Selecting the plus icon next to the current tax charge displays the transactions that make up that balance.

The Asset (Liability) balance shown at the end of each tax year represents the amount payable or receivable for that specific year, as at the end of the tax year for which you are preparing tax balances. Past year balances should reconcile to records held with Inland Revenue and any tax pools. Each year’s balance is included in the overall Asset (Liability) total at the end of the report, which represents the Current Tax balance: the amount payable or receivable at year end.

Tax payments

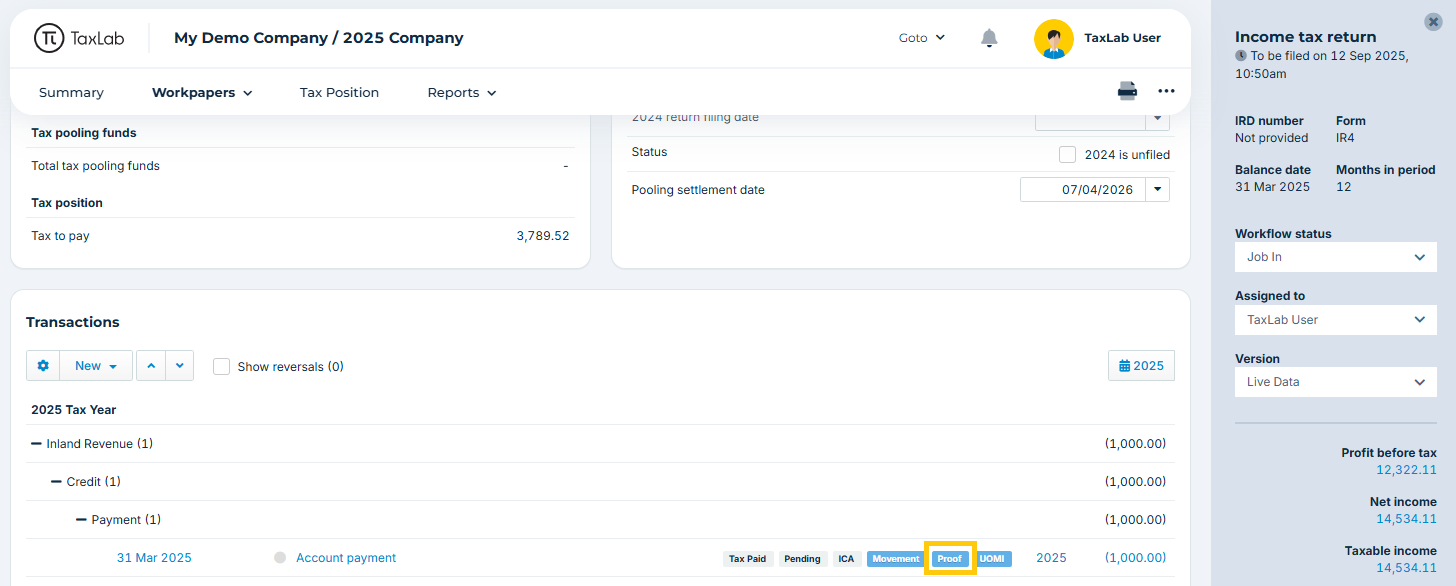

Payments made to Inland Revenue and tax pools will come through to the Current Tax Proof so long as they are marked as Current Tax Proof on the transactions:

Transactions that have a Journal date after the end of the current tax year will show but in light grey to indicate that they are a movement in a future tax year. They will not be included in the calculation of Current Tax Proof for the current tax year.

Add a prior period adjustment

Residual income tax (RIT) for a prior tax year can be added as a Prior Period Adjustment.

- From the Current Tax Proof, select New > Prior Period Adjustment.

- Edit the Tax Year to be the year the adjustment is required.

- Edit the Journal Narration to describe the entry, e.g. “202X Residual Income Tax”

- Enter the amounts of the journal into the Current Tax and Current Tax Expense boxes. This must balance. Any amounts entered in the Credit column should be positive values.

- Optional: Edit the default settings: Include in Tax account movements and/or Include in Current tax proof.

- Optional: Add Notes.

- Select Save.

Add a current period adjustment

- From the Current Tax Proof, select New > Current Period Adjustments.

- Edit the Journal Narration to describe the entry, e.g. “202X Residual Income Tax”

- Enter the amounts of the journal into the Current Tax and Current Tax Expense boxes. This must balance. Any amounts entered in the Credit column should be positive values.

- Optional: Edit the default settings: Include in Tax account movements, Include in Current tax proof and/or Is Ledger Reconciliation.

- Optional: Add Notes.

- Select Save.

Edit or delete an adjustment

- From the Current Tax Proof, select the adjustment you want to edit or delete.

- To edit the adjustment, make changes and select Save.

- To delete the adjustment, select Delete.

Troubleshooting

I can’t see my tax transactions

If payments are missing, navigate to Tax Payments and ensure that the Proof badge is displaying (i.e. Include in Current Tax Proof has been ticked).

Transactions are displaying in light grey

This means the payment is dated after the end of the tax year. If they happened before the balance date, navigate to Tax Payments and edit the Journal Date on the transaction.

Prior year assessments or residual income tax aren’t showing

These need to be manually entered. Refer to Add a prior period adjustment.

The total current tax balance is different to what I’m expecting

- In the Tax Payments section, check each tax year’s closing balance is reflecting the correct amount payable, receivable, or nil.

- Check all payments, refunds and other transactions that impact current tax have Include in Current Tax Proof ticked.

- Check that any prior period RITs are entered in each tax year as required.

Related articles

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article